What is Usage-Based Car Insurance?

Insurance is one of the costliest parts of owning a vehicle and most drivers would do anything in their power to lower their rates. But would you go so far as to hand over your personal driving data?

A fairly new initiative, some insurance customers can now sign up to plug in a logging device to their car, which can track a number of variables to see what kind of driver you are, and possibly lower your insurance rates. Called “pay as you drive” or “pay how you drive” these new systems bring up a lot of questions.

WHAT IS IT?

“So far they say that they will not increase your rates as a result of the information gathered from this technology,” explains Anne Marie Thomas from InsuranceHotline.com. “It’s all data and statistics, and that’s how insurance rates are set, on statistics. If statistically you’re in the low-risk range, then you should be paying less than those who are in the moderate or high-risk accident range.”

It doesn’t sound like a bad deal, but it’s important to know what information the insurance companies are looking at.

MILES

One of the main things that insurance companies want to know is how much you drive your car. While you may send rough numbers of how much you intend to drive your car in a year, it can vary from year to year. Insurance companies want to know exactly how much road is being covered by your car, and they will adjust your rates accordingly. For example, if you drive under 10,000 miles a year, you end up saving money.

“The less you drive, the less likely you are to be in an auto accident, and that should be reflected in your rates,” says Thomas.

The insurance company’s mindset is more miles means added risk, so if you drive less you’ll pay less for insurance.

SPEED

Insurance companies have reassured us that they don’t care about your actual driving speed, just your rate of acceleration or deceleration. If you accelerate 8 mph faster in one second, or decelerate 9 mph slower in one second, you’re considered to be slamming on the gas, or brake pedals, and driving erratically.

“Insurance companies consider this type of driving to increase your chances of getting into a rear-end accident,” Thomas explains. “If you’re following too close and adjusting your speed too much and too drastically, then you won’t get those discounts.”

The theory is that smooth driving habits are safer (and more fuel efficient too) and that if you’re not constantly hammering on the gas and brake pedals, then you’re a safer driver.

WHEN DO YOU DRIVE?

The lowest risk times are non-rush hour times, like 5-7 am, 9am-4pm and 6-10pm. Weekend driving is also considered low risk. The more you drive during these low risk hours, the more you’ll save.

UNMENTIONED BENEFITS FOR PARENTS

“When your kids are learning to drive, you don’t really have the sense of how they do on their own,” Thomas says. “Being able to see that data is helpful, so you can gauge what they’re like behind the wheel when you’re not there.”

It’s not too intrusive to know where and how fast the car is going in the hands of your teenager, but it’s handy enough for parents to help teach the importance of accelerating and decelerating smoothly in addition to driving responsibly. It also helps to quantify the impact of driving poorly.

Families with young drivers have to pay extra to insure the newer drivers, but signing up for this kind of insurance logging can help bring down those costs, while teaching an important lesson to the inexperience drivers in the household. Equally valuable is the extra peace of mind to a parent.

IS IT SAFE?

“Over the last ten years, we’ve tested several variables, including location and acceleration data. ” says Jeff Sibel from Progressive. “Our research shows that our current version, without location or acceleration, is appealing to consumers and provides us with an accurate picture of our customers’ driving habits.”

Early patents of the device list some GPS or cellular functionality to track your information, but it’s clear that customers weren’t comfortable with that data.

Other insurance companies have toyed with the usage based insurance idea. Another Canadian provider, Aviva, had a pilot program which was ultimately ended.

“The program was voluntary and we did not experience any issue with customer privacy concerns,” explains Aviva spokesperson Glenn Cooper, but he didn’t hint as to why the company didn’t follow through and offer the same program to all customers. “As it was only a pilot program, there was not a specific reason why we discontinued.”

NOT THE ONLY WAY TO SAVE

If you’re comfortable with trading discrete data about your driving habits for discounts on insurance, then these data-logging solutions will be a great avenue for you.

However, it’s important to know that by shopping around you can likely find lower insurance costs elsewhere, without having to resort to giving up potentially personal information about the way you drive.

“Sure you can get this technology to help you save money, but another way to save without any modifications to your vehicle is to just shop your rates,” Thomas says. “It’s entirely possible to find those savings at another company without resorting to the logging technology.”

So if you’re not comfortable with big brother watching, then you don’t have to sign up for it, and can save regardless just by shopping around.

Sami has an unquenchable thirst for car knowledge and has been at AutoGuide for the past six years. He has a degree in journalism and media studies from the University of Guelph-Humber in Toronto and has won multiple journalism awards from the Automotive Journalist Association of Canada. Sami is also on the jury for the World Car Awards.

More by Sami Haj-Assaad

Comments

Join the conversation

No way, no how. They may not raise rates now but they will, or cancel you. Wait till you're in an accident and the police want to look at it or the other drivers lawyers. And especially progressive with their owner or CEO. People complain about big brother and you would actually do this to yourself. Not worth 10, 20 or even 50%.

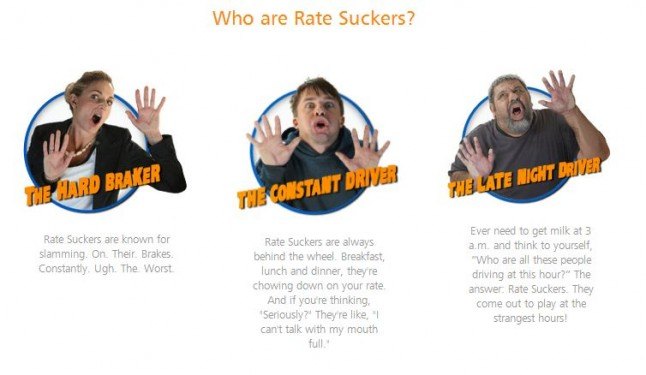

I resent the "rate suckers" portion of the Snapshot campaign, because it insinuates that those of us (even those of us who use Progressive) who don't want our driving habits tracked are somehow infringing upon some imagined rights accorded to Snapshot users. What's really happening is that Snapshot users are simply trading intel to Progressive for a very nebulous hope of lowered rates, with no transparency as to what discounts will be offered for exactly what mileage, speed, travel areas, etc. No sale.