Get the Most Out of Your Auto Insurance With Independent Insurance Agencies

When it is time to shop for car insurance, the most common way to do it is through an agent. But not all insurance agents are the same. Some work directly for one insurance company, while others are independent insurance agencies that can help you find the best value for your specific insurance needs. Here’s how you can get the most out of your auto insurance by using an independent insurance agency.

If you want multiple insurance quotes, you can spend a day calling every insurance company you’ve seen an ad for. That means repeating all your information time after time, sitting on hold, and hoping that you wrote down all the particulars of every policy from each company so you can figure out which one is the lowest.

Or you can browse on-line for an insurance agency. Insurance agencies are companies that act as a guide between you and potential insurers. Here’s what you can expect based on your preference.

Photo by hedgehog94/Shutterstock.com

Online Insurance Shopping

If you’re on-the-go or comfortable with a digital experience you can browse for personal insurance on an insurance providers website or compare policies on an independent agency website or application. A digital experience means you can shop on your own time. If you use an independent agency app, you can view competitive premiums from different insurance companies’ side-by-side. Depending on your comfort and familiarity with what coverage you need, the process may take less time. Look for sites that offer a phone number to talk directly with an agent, or at least a chat in case you have a question.

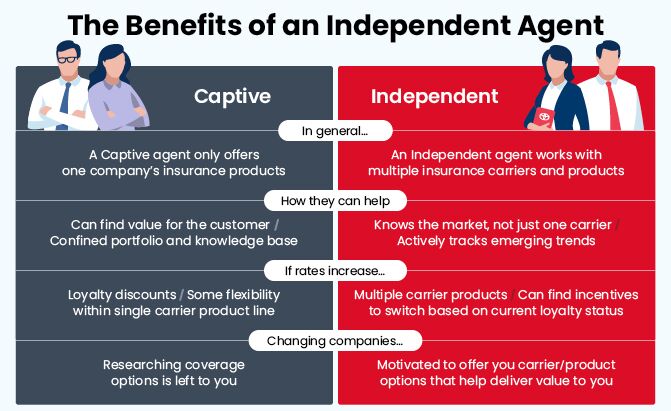

Independent vs Captive Agents

Some people prefer to work directly with an agent over the phone or in person. So, before you pick up the phone, here is what you can expect when working directly with an agent for an insurance provider or an independent agent.

Some insurance agencies, called captive agents, offer only the insurance products of one specific company. They may be able to find you the best value that one company can offer, but it’s not always the best value or even the best product available on the wider market for you.

An independent agent isn’t limited to one specific insurance carrier, and can take all your information, examine your situation and insurance needs, and then go to work for you. They reach out to multiple insurance companies, then get back to you with their best available rates and coverages for you, your family, and your vehicles.

Together for the Long Haul

A good relationship with an independent insurance agency can make finding insurance that’s right for you easier for years down the road. How?

Independent agents know the insurance market, not just one carrier. They stay on top of new or changing carriers, new products, and even emerging trends like ride-hailing and other side hustle gig economy work that can affect your coverage needs.

An independent agency can also have a better understanding about you, your history, and even your upcoming insurance needs. That can mean finding an insurance provider that offers a lower price for you, but it can also mean finding one that offers the right insurance for you helping you determine what you don’t need, and collaborating with you to get what you do need for your chosen level of protection.

Photo by ASDF_MEDIA/Shutterstock.com

Loyalty Matters

How long you’ve been with your current carrier can impact your rates. Loyalty discounts can work in your favor, but did you know they might also save you money by switching? Insurance carriers looking to win your business may offer discounts for customers like you who have been with their existing carrier for a long time. An independent insurance agent knows about these discounts and can help you find the solution that works best for you, and also help you shop at renewal for the best option in case there has been a rate increase or other change.

Even if you’re already with an independent agency, Toyota Insurance Management Solutions has benefits for you. They have access to the best products its carriers offer nationally, and offer a broad perspective on the world of insurance. This advantage gives you access to a wider range of companies who provide value for Toyota owners, instead of being limited to a single carrier. Plus, they know your Toyota vehicle benefits best, so you don’t pay for something you already may have such as Roadside Assistance which is included in ToyotaCare.

Photo by Sychugina/Shutterstock.com

Unique Products

Toyota also has access to insurance products that other agencies don’t. Those include Toyota Auto Insurance, where all policies can include Toyota Genuine Parts in the event of a claim. That gives you a guarantee of higher quality parts, not inferior aftermarket replacements if your vehicle is damaged and needs repair. Toyota Genuine Parts help ensure that your car, truck, or SUV is as high quality after a repair as it was before and can help maintain your vehicle’s factory warranty.

Toyota Insurance Management Solutions is also able to offer advantages in usage-based insurance (UBI) in select states and for select Toyota models. This empowers you to leverage your driving data to help determine your personalized insurance rating and this information can be used to offer real discounts on your insurance premiums, giving you a big potential upside to sharing your driving data.

Feature Photo By tommaso79/Shutterstock

We are committed to finding, researching, and recommending the best products. We earn commissions from purchases you make using the retail links in our product reviews. Learn more about how this works.

*This is a sponsored placement.

Evan moved from engineering to automotive journalism 10 years ago (it turns out cars are more interesting than fibreglass pipes), but has been following the auto industry for his entire life. Evan is an award-winning automotive writer and photographer and is the current President of the Automobile Journalists Association of Canada. You'll find him behind his keyboard, behind the wheel, or complaining that tiny sports cars are too small for his XXXL frame.

More by Evan Williams

Comments

Join the conversation