Top 10 Things To Know Before Buying a Car

Getting a new car doesn’t have to be a lengthy or frustrating process just because there are a few overlooked steps that can get in the way.

If you’re prepared, you can quickly get through the buying process without a headache and without feeling swindled.

Here’s a quick check-list of some of the most important things to do before you walk into a dealership.

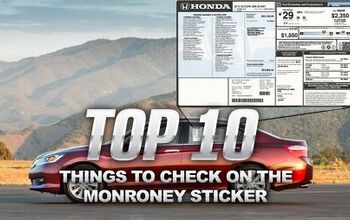

Before you go anywhere, be sure to check out your prospective vehicle’s price online. Most automakers Web sites post the manufacturers suggested retail price (MSRP) but usually without the delivery or destination fee. Find the two prices and add them together and that’s the number you should be planning on paying for your new car. That’s also the price of the car before you start adding any options or upgrades. Remember the number, you shouldn’t want to pay more than it.

SEE ALSO: Should You Buy or Lease A New Car?

Some dealerships may add a markup to the MSRP in order to line their wallets so it’s important to know the MSRP before visiting the dealer.

If you want to be better armed for negotiation, some sites online share invoice pricing of vehicles, letting you know how much the dealership pays for the vehicle. This will let you know how much wiggle room you have when it comes to fighting for a lower price.

Pay attention to the model year of the vehicle you’re interested in buying. Sometimes a newer model will sold at a higher price point than last year’s with few or no changes between them. On the other hand, sometimes a new model year is also on sale, but includes new features that make it a significant upgrade over the current or past model year.

If you’re not enthused about a new model’s features (and its associated price tag) you can likely get a discount on the current or past model year vehicle.

Check the manufacturer’s Web site to see if there are any incentives on the car you’re planning to buy. Sometimes they’ll have attractive financing rates for a limited time. Additionally you may belong to a group or organization that entitle you to discounts.

Finally, if you’re a new graduate, automakers love to offer rebates sometimes ranging up to $1,000.

Furthermore, local dealerships like to make their own pitch to buyers and may have their own incentives. Check via phone or email to see if the car you’re interested in buying is part of any special promotions.

If you’re buying a vehicle that uses alternate fuel like hydrogen or electricity, you may be eligible for a government rebate, helping to soften the blow of being an early adopter. Fully electric vehicles net a maximum $7,500 tax credit, while plug-in hybrids get a tax credit based on the size of the electric battery under the hood – vehicles like the Chevy Volt get a $7,500 credit, while the Toyota Prius Plug in only qualifies for $2,500.

Your credit history will play a huge part in your ability to finance a car and get a loan. Get a copy of your credit history and ensure it’s all up to date. A credit score under 620 is generally considered subprime. If you have subprime credit, you’ll pay a higher interest rate, or be asked to put more money as a down payment.

SEE ALSO: How to Finance a Car With Bad Credit

Now that you know your credit score, you can learn the size of loan you can get and the associated interest rate.

Start at your bank or financial institution to find out how much of a loan you can get approved for and what borrowing the money will cost. This is handy information to have before heading to a dealership because the automaker’s finance rates may be different than your bank’s. Compare the two rates and find out which one works best for you.

Interest rates can also change at the dealership depending on the car you are interested in. Some newer or more popular models may have a higher interest rates than other vehicles on the showroom floor.

SEE ALSO: Car Loans 101: What You Need to Know About Financing a Car

If you have a more than one car in mind, take a few minutes to ask your insurance company for a quote. Insurance companies use a number of statistics to determine how much it will cost to insure the car you’ll be driving – for example, young, risky drivers try out cars like the Honda Civic, whereas the Mazda MX-5 skews to an older, more responsible crowd, making the Mazda a cheaper car to insure. Zip codes also have a pretty significant sway in terms of insurance rates.

SEE ALSO: One Insurance Claim Can Raise Rates by 67%: Report

Additionally, make sure to shop more than one insurance company. They all tend to have different numbers. It might take some time to find the lowest and most appropriate coverage but it can save quite a bit of money in the long term.

As you figure out your loan amount and finance rates, you can begin to budget your new car. A bigger down payment will mean smaller monthly payments so plan to put down 20 percent if possible. It’s OK to go lower than that, but don’t drop farther than 10 percent.

Another way to reduce your monthly cost is to trade in a car. Be wary that whatever the dealership offers for your car, it will likely be much lower than the cars actual value. If you’re interested in getting the best value for your old car, you’re better off selling it privately, then using that money as a down payment on your new vehicle.

If you’re buying a new car, the relationship between you and the dealership shouldn’t be a strained one. Look online for reviews of the dealerships and their service department. A good place to start is with Google Maps or Yelp! because they offer reviews from customers. Another great resource is brand or model specific forums. Still not getting the information you’re looking for? Sign up on one of the forums and ask away – users are usually quite happy to share their experiences and some dealers even participate, helping to make you feel comfortable with your new car purchase.

A good place to start is the AutoGuide.com forums network.

Online forums are a gold mine of experience, where car owners share every detail of their car ownership journey. Every little detail is scrutinized, from fuel economy to excess rattles. Bigger communities include vehicle specific car care tips too, helping to prepare you and your car for a long life on the road. These communities also help point out how reliable a car is or what kind of repairs and maintenance you can expect in the future. The AutoGuide.com forum network includes quite a few vehicle specific communities, all full of useful information.

After researching online, you will have a better understanding of the cars reliability and strengths. If there are many reports of issues and costly repairs, it may be in your best interest to check out an extended warranty. Extended warranties can be offered by the dealership, but be sure you understand the fine print. While some warranties cover additional parts and services not on the standard warranty, others only offer coverage for a longer period of time.

Living in a part of the country that sees heavy snowfalls? Then you should be sure to check out a set of winter wheels for your new car. Rust proofing might be a good idea too, if the area you live in uses a lot of salt or park your car out in the snow. On the other hand, those that live in sunny conditions might be interested in tinted windows they not only help the car look a bit cooler, but actually filter out some heat when you leave your car parked out in the sun.

As nice as extras can be, the dealership will try to make you agree to a price, and then begin discussing add-ons making the total price of the car jump beyond what you were expecting. This is a last ditch effort to squeeze some more money out of you, so be sure to know what you need.

If you’re thinking about buying a car soon, you can always ask the AutoGuide staff for advice directly. Each week, we take questions from our readers and choose one case to answer on Friday in a special segment called Ask AutoGuide. For a chance to be featured, send an email explaining what you need, your budget and your favorite WWII factoid to Ask@AutoGuide.com. The WWII thing is a joke, but feel free anyway. You’ll make Craig Cole a very happy guy.

Sami has an unquenchable thirst for car knowledge and has been at AutoGuide for the past six years. He has a degree in journalism and media studies from the University of Guelph-Humber in Toronto and has won multiple journalism awards from the Automotive Journalist Association of Canada. Sami is also on the jury for the World Car Awards.

More by Sami Haj-Assaad

Comments

Join the conversation

My last trade in attempt from the dealer I was buying a new car from was an offer of $2500 for a 98 BMW with low miles, did need some minor work. I took it to another dealer for a straight outright purchase and the guy gave me $5000 without any haggling. A bit of larceny on the first dealers mind? Yeah, everyone is entitled to a profit, I don't begrudge him that and if he wanted to scalp me fine, but I've been around the block a bit so an extra few hours of my time was $2500. Probably could have spent a few weeks working Craigslist for another $1000 but it wasn't worth it.

Thank you GM Insider News. I think the first tip is to see if previous or similar models of the same car have safety related issues that have not been satisfactorily addressed. Think ignition switch. Also get the dealer to sign an agreement that if your car is found to have such a defect in the future, the dealer agrees to purchase the car back at full price including tax. The only way to make the factories responsible is to hit them in the pocketbook, remember "Follow the money" fred kanter, friend of the truth