Ford, Honda Projected to Gain Market Share in New 'Car Wars' Study

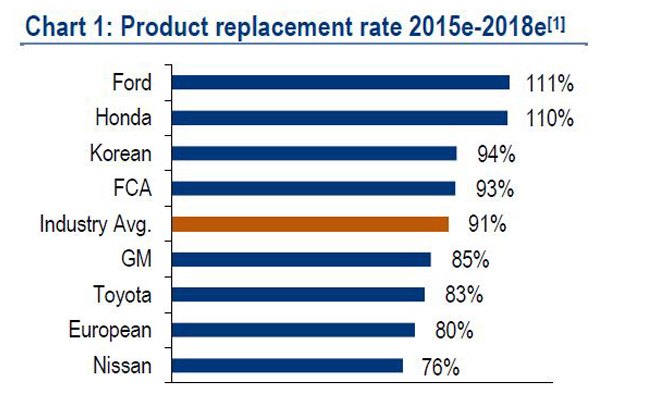

The analysts and number crunchers at Bank of America/Merrill Lynch released the findings of their latest Car Wars study, a report that tracks industry product trends. The results are surprising; market-share fluctuations are expected to remain small. But Ford and Honda are both projected to gain in the coming years with Nissan on track to lose share.

John Murphy, a research analyst at the financial firm presented the results at an Automotive Press Association luncheon in Detroit. The Car Wars study has been published annually since 1991 and provides a wealth of information about things like vehicle replacement rates, automaker showroom ages and where the model mix is headed.

According to Murphy they forecast “every single product that will be launched in the U.S. over the next four years,” which makes this study very comprehensive.

BRICK BY BRICK, BREAK BY BRAND

Some of the juiciest information to come out of Bank of America/Merrill Lynch’s study deals with some of the major OEMs. The financial firm projected how well will each of the big automakers will do in the near future and the results are unexpected in some areas. Here’s how it breaks down for each brand covered.

Historically GM has had a low vehicle-replacement rate hovering around 14 percent. But going forward that’s set to jump to 21 percent as they push new vehicles out between now and 2017. The Car Wars study indicates that introductions will slow down slightly in 2018. Murphy said, “GM is a little bit depressed on the replacement rate,” because they pushed their brand-new full-size truck out last year but, “GM’s replacement rate is probably going to be good enough over the next two years to maintain its market share.”

Like its cross-town rival, Ford’s historical replacement rate is just 14 percent, but between 2015 and 2018 it’s expected to increase to 28 percent, which is much greater than the industry average. This should result in a mean showroom age that’s a lot less than the industry average. Predictably Ford’s new product will skew toward trucks, with a brand-new aluminum-bodied F-150 set to launch this fall and a new a Super Duty in 2016. In the coming years the Blue Oval is expected to gain market share, perhaps up to 0.5 percentage points by 2017, though they may trade some of this for greater profits by increasing prices.

GM and Ford ought to do pretty well in the coming years but the forecast for Fiat Chrysler Automobiles isn’t as bright. Their average replacement rate should be right around the industry average of 23 percent for the next four years, which is good. Unfortunately it’s estimated to decelerate in the coming years. Murphy said Marchionne’s plan for gaining four points of market share is “a pie-in-the-sky idea.” In fact if the brand-new Chrysler 200 is not successful they risk losing share.

“We’ve got to keep an eye on Toyota,” said Murphy, he also noted that the brand’s performance could be “pretty weak in the next two years.” Their market share is projected to remain flat due to a below average number of product introductions in 2015 and 2016. However, there will be a significant wave of launches in 2017, which could offset the lull.

Steady as she goes; that’s what appears to be happening at Honda. The Japanese automaker is in the sweet spot of its cadence with redesigned versions of key vehicles set to be introduced in the next few years. Murphy said, “They are consistently turning their product.” Thanks to good planning and focused brands Honda is projected to gain half a point of market share by 2017.

But not all the Japanese brands are doing so well. “Nissan seems to be a ship without a rudder,” Murphy said, adding that they’re one of the few companies that are at risk of losing share over the next four years. Its vehicle-replacement rate lags the industry and is quite volatile.

Changing continents, European brands are expected to lose market share in the coming years. Volkswagen is the volume player in this segment and Murphy said they’re in the same boat as Nissan; their product introductions are “not very robust going forward.”

Finally, Hyundai and Kia have just had a two-year product lull but they’re poised to pick up the pace. Historically their replacement rate is high at about 24 percent; again the industry average is 23 percent for the past two decades. The conclusion for these two brands is that they’ll remain stable.

OTHER FINDINGS

In decades past the automotive industry was a boom-and-bust business. Companies were constantly riding the wave, from impressive highs to debilitating lows; change was the only constant.

Fortunately for everyone involved Murphy said, “The market share shifts of the last few decades are largely over.” Companies are competing with product, not price. Pretty much every automaker builds great vehicles these days, they don’t desperately have to cut window stickers in order to move the metal.

“The industry has gone through a massive rationalization of capacity,” Murphy said, noting that “GM is largely right-sized.” He said they will no longer hemorrhage market share like they did in the bad old days.

Murphy also said Bank of America/Merrill Lynch is “really bullish across the board” for the automotive industry, noting, “Market-share shifts are going to be relatively small.”

Murphy said that having a showroom full of fresh product is critical to growing sales, increasing market share and boosting stock price. Good news for all automakers is that the average showroom age in 2014 is just 3 years. That figure is projected to drop in the coming years, falling to just 2.1 in 2018.

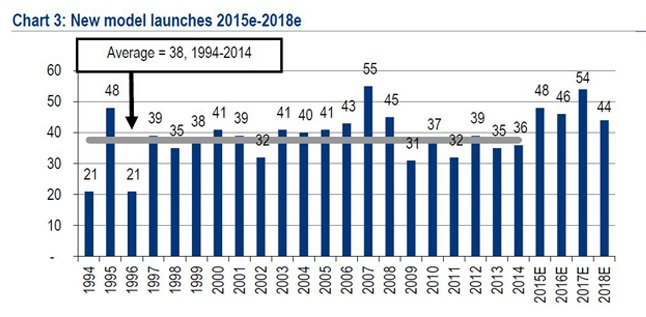

Additionally, vehicle launches are accelerating. Between 1994 and 2014 automakers introduced an average of 38 new cars and trucks per annum. In the coming years that figure is estimated to accelerate appreciably, hitting an 54 introductions in 2017 as OEMs push to deliver fresher products.

Wrapping things up, Ford and Honda could gain between now and 2017 because of their favorable product replacement rates. The Korean brands, Fiat/Chrysler, GM and Toyota are likely to remain flat while European OEMs and Nissan are estimated to lose market share. Fortunately the swings involved are projected to be small because the industry has adjusted its manufacturing capacity to meet demand and everyone has solid products. This is good for consumers and automakers; buyers have lots to choose from and manufacturers are no longer locked in a “race to the bottom,” cutting prices to sell vehicles.

Born and raised in metro Detroit, Craig was steeped in mechanics from childhood. He feels as much at home with a wrench or welding gun in his hand as he does behind the wheel or in front of a camera. Putting his Bachelor's Degree in Journalism to good use, he's always pumping out videos, reviews, and features for AutoGuide.com. When the workday is over, he can be found out driving his fully restored 1936 Ford V8 sedan. Craig has covered the automotive industry full time for more than 10 years and is a member of the Automotive Press Association (APA) and Midwest Automotive Media Association (MAMA).

More by Craig Cole

Comments

Join the conversation

Usually, it is BS. This kind of research/study/report is sponsored by certain automaker. In this case, it is likely Ford that sponsored the study as it's marketing effort.