40 Percent of Hybrids Cost Less To Own Than Gas-Powered Equivalents

Hybrid vehicles have been sold in the U.S. for 17 years since the launch of the 2000 Honda Insight and Toyota Prius, and their value proposition compared to conventional alternatives has in many cases improved.

A recent analysis by Michigan-based data analysis firm Vincentric found despite a cost premium on average of $3,722 for 65 hybrid trims of 24 models studied, 40 percent of these cost less to own than conventional nearest-equivalent gas-powered counterparts.

In many cases this means the hybrid version of a car that comes in both hybrid and conventional powertrains was found to be a better economic proposition despite an initially higher out-of-pocket cost.

This is all the more impressive in that unlike plug-in electrified vehicles, hybrids are not being propped up by subsidies. They used to be until 2011, but even in their heyday, hybrid incentives might have been up to a few thousand dollars. Hybrids are not as cost intensive as the larger lithium-ion-battery dependent battery electric and plug-in hybrid vehicles eligible for federal tax credits from $2,500-$7,500, and state credits from several hundred dollars to a few thousand.

Hybrids do still cost more to buy than nearest-equivalent conventional vehicles because no matter how many manufacturing costs are amortized and commoditized, they merge two powertrains – electric and gasoline. This said, because costs have declined, they can be a genuine good buy.

Of course there have been glaring exceptions. Take for example, the recently discontinued Lexus 600h L, a hybrid that could command a $50,000 premium over a conventional LS 460 counterpart – enough of a cost premium in itself to buy a Tesla Model 3, Chevy Bolt EV, Volt, etc. That Mercedes-Benz S-Class level car did make its buyers feel better ostensibly going green(er), but actually netted just 2 mpg better, and made reviewers scratch their heads wondering why Lexus bothered selling fewer than 50 per year.

But many other hybrids – including numerous Toyota and Lexus models – do make good financial sense, as Vincentric found out – indeed an entry level Lexus (also on its way out) ranked number one.

2017 U.S. Hybrid Analysis

But it’s a mixed bag and Vincentric found there are hybrids that do not pay back in outright cost-of-ownership. In the U.S., there are actually only around 30 hybrid models, some of which sell in very small numbers.

The analysis of 24 better-known models broken into 65 sub-level trims is particularly valuable because it goes beyond mere sticker price, and attempts to calculate what a consumer would really have to pay over five years, assuming 15,000 miles per year. In other words, it weighs whether a specific model is really a good prospective purchase from a dollar and sense point of view.

Factors weighed included the current market price of the vehicle along with depreciation, fees and taxes, financing, fuel cost, insurance, maintenance, opportunity cost, and repairs. Fuel costs were estimated on a five-month weighted average (not the latest price, for greater accuracy).

Compared to 65 non-hybrid nearest equivalents, researchers found this year hybrids are on the rebound, and the number of good-value hybrids increased 16 percent over a 2016 study. The percentage of cost-effective hybrids had been decreasing since 2012, but this year more cars bucked that trend.

Among types of hybrid vehicles having the highest percentage of cost-effectiveness are luxury cars at 46 percent of the total. A lower percentage of cost-effectiveness is experienced by passenger cars at 39 percent and SUV/Crossovers at 36 percent.

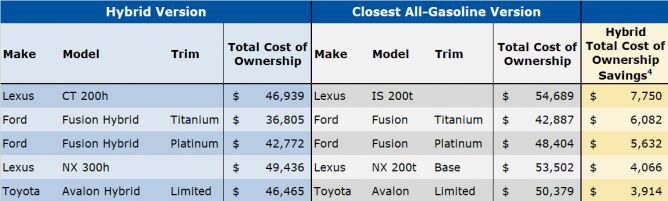

The outright winner is a car being discontinued – the Lexus CT200h – which Vincentric calculated could save buyers $7,750 over 5 years of ownership compared to the similarly equipped Lexus IS 200t.

A comparative non-starter by contrast was found to be the Infiniti Q50 Hybrid Premium for which buyers would spend $8,315 more to drive than a similarly equipped Infiniti Q50 Premium.

Ownership savings are maximized, found the researchers, when the savings from lower fuel costs and lower depreciation rates outweigh the price premium for a particular hybrid.

“Our study showed a significant increase in the percentage of hybrids that can save buyer’s money over five-years when compared to an all-gas counterpart,” said Vincentric President, David Wurster. “Understanding the value of hybrids requires looking at all ownership costs, and not just fuel savings. Only then can buyers determine whether it makes sense to pay the hybrid price premium.”

More Qualifiers

Not surprisingly, most hybrid vehicles cost more to purchase. This in turn increases factors including depreciation, financing, opportunity costs, taxes, and fees.

On the face of it, this is enough to scare some people off from considering a hybrid, but on closer look, they do stand to make it up on the back end.

For starters, once you take home any nice shiny new vehicle, be it hybrid or gasoline, you’ll be developing a new relationship – with the fuel pump. Assuming you don’t want that to be as expensive or as often, here’s where hybrids start to become more endearing.

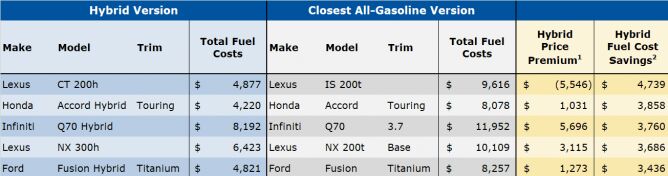

Vincentric’s analysis found that around 25 percent of the hybrids studied fuel savings alone was enough to offset their price premium – and that’s even though fuel is at a relative low compared to a couple years ago.

On the flip side, because conventional cars are becoming better with fuel consumption and because of the decreased prices for gas and mentioned, hybrids overall are becoming less cost-effective.

The researchers say that overall, shoppers need to seriously assess their needs, and the models available to them. Factors like negotiating a better deal can also tip the scales, says Vincentric, as can driving patterns and intended length of ownership.

One Solution out of Many

A quick look at what consumers are voting for with their wallet can be had by perusing the HybridCars.com Dashboard, a monthly spreadsheet of hybrid and other energy efficient vehicle sales.

Hybrids are essentially a solution to petroleum usage and emissions, and as of yet, the best sellers do better than the best-selling battery electric and plug-in hybrid models.

Buyers whose mindsets are cued into these factors have however migrated towards EVs and PHEVs as the cleaner solutions which explains their rising popularity. Being new, and on the rise, plug-in vehicles also get the majority of press as hybrids are to some familiar news.

Be that as it may, automakers still consider them a linchpin to their portfolio of vehicles and the best get upwards of 50 mpg, or high 40s by EPA reckoning. They require no new behaviors or access to a charging network, their batteries tend to last and costs as noted are coming down.

Independent repair shops also are more familiar with them, and they basically work like any conventional car and are the entry level to electrified vehicles that can still get 10,15,20 mpg better than some of the other choices out there.

Become an AutoGuide insider. Get the latest from the automotive world first by subscribing to our newsletter here.

Aaron is a freelance writer, videographer and car enthusiast based out of the Detroit area. He has a special affinity for the Porsche 944 series, and once owned a Volvo 240 sedan with a Weber carb in place of the factory EFI system. His work has appeared on AutoGuide, GM Authority, /Drive, and VW Vortex, among other sites.

More by Aaron Brzozowski

Comments

Join the conversation