What's Really Motivating Automakers To Build Electric Cars?

Today most major automakers say they’re eager to build electric cars, many have announced new models with more pending, but none would be doing this if they did not have to.

To some observers, this may be obvious, and to others just loosely aware of the facts and fancies surrounding the electrification of the automobile, factors driving automakers away from the internal combustion engine may be a bit less clear.

One could be forgiven for holding vague notions too, as talking points, sound bites, and even a tinge of greenwashing have filled media headlines, automakers’ statements and other communications shaping the conversation. Complicating the mix have also been voices countering stated reasons for switching away from society’s monopoly energy source – petroleum.

Some of the bigger goals underlying automotive electrification include desires to curb climate change emissions, environmental health concerns, the elusive perpetually on the horizon goal of “energy independence,” and sustainability.

These are indeed factors, but behind them, all is the core reason, and this is greenhouse gas and mpg regulations in the U.S. and around the world.

Global regulations encompass all the other rationales we so often hear and are forcing automakers to comply or pay – the worst form of pain for multinational corporations, and thus an effective prod.

If this seems overstated, imagine a world without regulations. It’s not going to happen, but think hypothetically for a minute. If all global emissions and mpg regulations were revoked, and a pure laissez-faire economy let automakers do what seemed best to them, would they be as motivated to undermine their already established, profitable, and in many cases amortized internal combustion technology?

Michigan-based auto analyst Alan Baum thinks not, and cites regulations as the key catalyst driving the market forward. And, given that they are an ever-present reality and certainly not going away, Baum says automakers have embraced them, and are working within the system.

“The automakers, A) benefit, and B) actually support regulations that are consistent not just in one country, but across the globe,” said Baum because they can develop vehicles for all markets, and not have to follow a patchwork of conflicting laws. “The flip side is, if all regulations went away, would they be happy? Sure they would because then they could do what they want, but if there are going to be regulations, they want them to be consistent.”

Baum also notes the EV market in the United States is pushed more by California Air Resources Board (CARB) zero emission vehicle (ZEV) mandates than federal regulations.

By contrast, U.S. Corporate Average Fuel Economy (CAFE) rules give greater leeway to internal combustion, and the EPA has said no more than 1-3 percent plug-in cars are required by 2025.

Not so in California, Baum said, which mandates one-in-seven by 2025.

“In the absence of CARB, timing for new electric cars might be 3 or 4 years later, and a lot of the vehicles would not appear at all,” said Baum. “The California ZEV has forced automakers to say ‘OK, we have to have the technology in place; we won’t have to execute it in volume very quickly, but we can’t just sit on our hands and see what happens.'”

So, while some may allege conspiracy theory, there is no conspiracy. The evidence is plain to see. Although automakers are proficient at developing and selling new vehicles in the 89-million annual global market, they are flexing their industrial muscles only as fast as needed to stay ahead of regulations, and in some cases are lagging behind, observed Baum.

This thought is also expressed by Tesla’s investors website.

We believe that more than 100 years after the invention of the internal combustion engine, incumbent automobile manufacturers are at a crossroads and face significant industry-wide challenges. The reliance on the gasoline-powered internal combustion engine as the principal automobile powertrain technology has raised environmental concerns, created dependence among industrialized and developing nations on oil largely imported from foreign nations and exposed consumers to volatile fuel prices. In addition, we believe the legacy investments made by incumbent automobile manufacturers in manufacturing and technology related to the internal combustion engine have to date inhibited rapid innovation in alternative fuel powertrain technologies. We believe these challenges offer a historic opportunity for companies with innovative electric powertrain technologies and that are unencumbered with legacy investments in the internal combustion engine to lead the next technological era of the automotive industry.

Push and Pull

The auto industry is one of the most regulated in existence as it is responsible for building millions of machines in which humans trust their lives and safety.

In playing the high stakes game writ large, industry lobbies have a history of pushing back against regulations. It was regulations and advocacy that forced against initial resistance innovations like 5 mph bumpers, three-point seatbelts, improved crumple zones in vehicle bodies, air bags, anti-lock brakes, and more.

All those changes cost money, and just as in a court settlement, automakers have brought arguments – sometimes valid, sometimes not so much – against what will cost them.

In 2002, the Auto Alliance, a lobby group representing 13 automakers successfully pushed back against California law in federal court.

California’s zero emission laws were an inspiration for the first major manufacturer electric car, GM’s EV1. In 2002 after the industry successfully pushed back, GM recalled the EV1 and subsequently crushed them in Arizona.

Presently, the Auto Alliance is again pushing back on behalf of the automakers – all of which will otherwise say they are on board with the sustainable and environmentally sensitive ethos now trending.

As in 2011, when the Auto Alliance said “62 mpg” federal CAFE rules – later negotiated down to “54.5 mpg” – would lead to the “loss of almost a quarter-million jobs,” it is again coming up with studies and data to support similar allegations against CAFE 2022-2025 midterm evaluations. These are a review of tightening federal mpg/CO2 regulations for this time period leading toward approximately 37-40 mpg on window stickers by 2025.

Among talking points being spoken into the ears of regulators, legislators, and the media are again that jobs will be lost, and consumers will be faced with cars much more expensive than the EPA estimates. Further doubt sown is that automakers will be forced to build cars too few will buy, and given how cheap gas is, Americans are showing their druthers for more gas-guzzling vehicles than ever, and the Alliance is seeking a lessening of the standards for 2022-2025.

In it To Win It?

Are plug-in hybrids and all-electric cars like an either/or proposition, a zero sum game between them and the “entrenched paradigm” of internal combustion, or is there room for all? Some have said no, others have said maybe or yes.

Tesla chief Elon Musk has spoken of an “inherent conflict of interest” automakers have in selling truly competitive EVs alongside gas counterparts. He says if automakers make their bread and butter on gas-powered cars, selling an EV as outright better technology works against that dealer’s (and automaker’s) interests.

For now also, price for performance is in the internal combustion cars’ favor by some, if not all measures. Sticker prices between say, a Nissan Leaf and Versa, or Chevy Bolt and Sonic, mean some may have to maximize the energy superiority advantage EVs afford, and collect maximum subsidies as available to see them financially pay back.

EV advocates otherwise have pointed out successful use cases and ways to make them work for the family budget. EVs are more often leased which can make better sense, and consumers often volunteer as amateur EV ambassadors and say they’re happy with their choice.

Benefits include silent drive, enjoyable new technology – up to performance car levels from bigger battery cars like Teslas and to a lesser extent the 2017 Chevy Bolt – but alongside this discussion is the automaker commitment, or lack thereof.

While automakers are making forward-looking statements for new EVs every week, it is tiny under-funded Tesla which last month sold an estimated 6,700 electric cars out of a total 10,000 U.S. deliveries amidst 10 other major automakers.

Why have none of the majors developed a real apple-for-apple competitor for the Model S yet? Some fans say they cannot, or lack the competence, but if there is anything automakers can do, it’s making new cars, even electric ones, though this can be a delicate subject. Auto executives have at times been publicly pilloried by EV fans when they let loose statements like Tesla won’t own the market forever, and implicitly say their German engineering heritage, for example, will rise to preeminence once again.

But despite pride and ego added to a newfound desire to hug polar bears, sales are a bottom line marker of automakers’ real intent at pushing the envelope any sooner than they have to.

Also telling is a complete vacuum of larger plug-in vehicles like Americans prefer – including pickup trucks, mainstream-priced SUVs, mid-sized crossovers – and for now only eco cars are offered in the sub-$40,000 segment as a niche among niches.

‘Leaders and Laggards’

Recently the Union of Concerned Scientists evaluated the U.S. plug-in hybrid and battery electric vehicle market and assessed the actual commitment automakers are expressing – not by their talk, but by their actions.

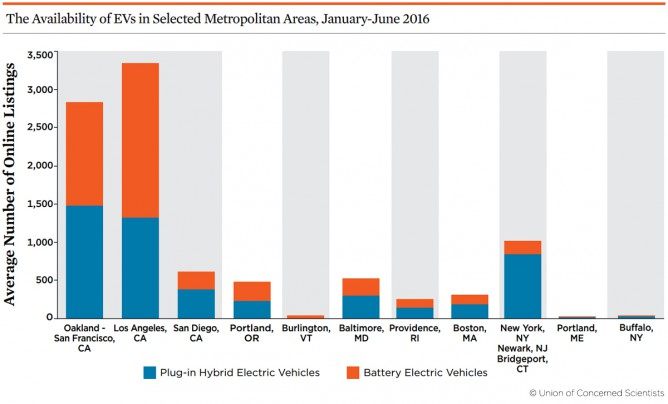

In calling out “leaders and laggards,” the UCS observed 24 plug-in electrified vehicles were introduced between 2010 and 2015 with more than 400,000 sold (the current count is over 522,000). What it found was the focal point was indeed the center of the regulatory universe, California, which last year bought 54 percent of American’s zero-emission vehicles.

“In 2015, Californians could choose from over 20 models; no other state had more than 14, and many offered virtually none,” said the UCS. “The difference between metropolitan areas was even starker. For example, between January and June of 2016, Boston had 90 percent fewer EV listings than Oakland, when adjusted for relative car ownership.”

Tales of dealers outside of California being uncommitted to stocking and selling vehicles, or sales people not as knowledgeable as the person trying to buy the plug-in car have been common anecdotal lore for the entire period.

Aside from Tesla which sells factory direct, automakers rely on franchised third party dealers. They do have a fair degree if not ultimate control over these franchises, but otherwise the availability of cars for sale outside of California and states that follow its zero emission rules is quite telling.

Leaders according to the UCS are BMW, General Motors, Nissan, and Tesla – and the Volt, Model S and Leaf account for about half of plug-in electrified car sales.

Laggards include Honda, Toyota, Fiat-Chrysler, Hyundai/Kia – though this latter is making inroads, and has an agenda to be a leader by 2020.

Self Interests

While both advocates and antagonists to the Tesla-esque ethos have been known to laud purported heroes and castigate alleged villains, as sure as John Maynard Keynes and other economists have said, all are following their self interests.

It thus may be a surface treatment of facts to make black-and-white judgments of Tesla as pure hero, for example, and Toyota as pure villain.

If put in the shoes of the legacy automakers, others might not do much differently. Automakers are financially tied to internal combustion to the tune of billions, and are emotionally and culturally wedded to them after a century of storied history as well. Practically, automakers make the majority of their revenues on more-profitable vehicles, not least being trucks and SUVs – which the American public does buy, through no actual fault of the automakers.

To give some perspective of the fix carmakers are in, imagine you inherited a family farm that grows radishes and squash, and you bank millions every year (this is a metaphor for the car business). Then imagine the government comes to you and says your produce is somehow bad for the environment, and you must switch over, but in doing so you need to retrain your workers, sales force, make new supplier agreements for new seeds, capital equipment, change your marketing and retrain your customers. And, costs will be higher, while there’s also no guaranty turning away from your former revenue source and way of life will be more profitable. Worse, what if you really love radishes and squash? What if you have doubts the government is taking the right approach but were faced with the force of law, so had to tow the line?

That’s a very simplified metaphor for what legacy automakers are going through, while on the other hand you have Tesla.

The Tesla Counterpoint

Tesla correctly says others are virtually wedded to internal combustion, but just as true is that it is not. It therefore has nothing to lose, and everything to gain in going gonzo for EVs now. What’s more, its products with the goal of saving the environment dovetail into government plans and the present regulatory environment.

Among benefits received from the regulatory regime are that Tesla was propped early on by a $465 million federal loan before its stock took off enabling it to repay it early. Further, 100 percent of Tesla’s products are eligible for a $7,500 federal tax credit – better than 10 percent of a base Model S – and its buyers can count on various incentives in several U.S. states, and other foreign markets. As an extra added bonus, Tesla has pocketed hundreds of millions of dollars by selling green credits it receives by California Air Resources Board rules, which is like money out of thin air – and a sweet deal in that the competition has to buy them.

While legacy automakers unsure of the path they are being pulled along have pushed back against regulators, Tesla’s Musk has been known to express frustration and dismay that California ought to be ashamed of itself for not being tougher.

In short, Tesla is in a unique position without baggage to play the hero. Nor will it miss the glory days of any gas-burning vehicle, as it’s never spent a dime on these.

This is not to say Tesla’s message lacks integrity, but simply that it is unencumbered like others are. Tesla has been credited with a brilliantly timed business. It has also been looked at as a visionary, or at least exceedingly clever, while antagonists – or alleged stock market “short sellers” – have called it a scam.

Tesla positions its products in sync with other trends besides, is playing an important role, and represents many qualities, but one thing clear is that it’s working for its own best interests, and other automakers are working for theirs.

For that matter, consumers are advocating their interests, environmentalists theirs, oil companies theirs, and so on.

Common sense? Economics 101? Maybe so, but it can get lost in the shuffle in a world where people tend to like a simple narrative, even a team to root for – or against.

Tesla has been credited as a protagonist pushing majors to catch up, and it now is – though automakers that are staying ahead of regulations are otherwise profitable, some reporting record profits, thanks to the internal combustion hardware they purvey.

True though, the Model S, and to a lesser extent the Model X have gotten the attention of the likes of Mercedes, BMW, Audi, and others, but even more serious are 2021 European Union emissions rules which are forcing change far faster.

Baum observes Tesla could not be more than a boutique niche, like Detroit Electric, without the zero-emission regulatory paradigm enabling it, and its fundraising efforts. Tesla wants to balloon from 50,000 to 500,000 sales in a couple years, and no startup has morphed to volume automaker status to this degree in many decades, Baum said, but of course it is managing much more based on the bedrock foundation of regulations.

“Tesla is using the regulatory system as a springboard, but they understand to be successful so much more is needed, and they are doing their best to be a mainstream provider,” Baum said.

Among these is developing compelling cars desired in their own right, bypassing the franchised dealer model which also serves its aims, and keeping customers for the most part happy with the new alternative it represents.

Making a Market

From a 30,000 foot view, everything thus rises and falls on global mpg and greenhouse gas regulations.

As regulators clamp down this decade into next, and as automakers are now coming to terms with their regulator-mandated goals – and marketing themselves as energetically embracing them – synergies are coming into play, if slower than some would have liked.

Now even alleged laggards have electrification in the works, and the jump-started market is taking on a life of its own. Normal market forces like competitiveness, consumer demand, economies of scale, and declining costs are kicking in despite reluctance and adherence in some quarters to little more than the letter of the law.

Being a global market, the U.S. led by California was the early leader, but last year Europe and China began pulling ahead, with the latter now the world leader.

“China’s requirement to reduce emissions will actually assist automakers in development of their models for the world since most automakers want to participate in the growth that it offers,” observed Baum.

Still, in its infancy with a mere 1 percent of the U.S. market and a slim minority in all other major markets, the electrified car industry is due for many more shifts, potentially much faster growth going forward – barring further complication.

Become an AutoGuide insider. Get the latest from the automotive world first by subscribing to our newsletter here.

More by Jeff Cobb

Comments

Join the conversation